Housing and subprime woes

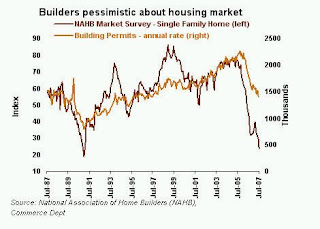

Housing and subprime woes Continue to monitor the housing market closely because believe that it poses significant risks to consumers and the U.S. economy. While housing starts bounced back 2.3% in June 2007, building permits (a leading indicator) fell 7.5% to the lowest level in nearly a decade. This reflects the dismal outlook by builders, as does the new low set in the National Association of Home Builders (NAHB) market survey (–4 to 24).

Excessive inventories of new and existing homes result in declining home prices. The NAHB now expects house prices to decline 5.1% this year, as buyers retrench in the face of tougher lending standards and higher borrowing costs. One way to illustrate the borrowing costs is to look at mortgage rates in real terms: mortgage rates minus the change in house prices. As demonstrated in the chart below, potential home buyers find it harder to rationalize purchases.

Subprime borrowers are in a particularly vexing situation. As their typically variable-interest-rate loans face higher reset interest rates, declining home values exacerbate their problems and prohibit them from refinancing. All of these conditions contribute to the blowup of the subprime mortgage market. Foreclosures increased 87% year-over-year in June 2007. While the foreclosures currently only affect approximately 0.5% of the mortgage market, there are significant interrelationships within the multitrillion-dollar global derivatives markets. This is the stuff that financial crises are made of. Following Moody's and Standard & Poor's downgrades of billions in mortgage-backed debt securities, as well as the Bear Stearns disclosure that two of its hedge funds are worth nothing, the ABX index fell to fresh lows.

Subprime mortgage market continues to suffer

Federal Reserve Bank of Philadelphia President Charles Plosser is keeping an optimistic view on the matter, saying that "in the context of the economy as a whole, it's a relatively small piece of what's going on ... don't see the same kind of credit crunch in the banking system as in the past." Indeed, liquidity remains robust throughout the global economy, providing ample capital for private equity firms to continue their acquisition frenzy.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Data contained here is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. All expressions of opinions are subject to change without notice

Federal Reserve Bank of Philadelphia President Charles Plosser is keeping an optimistic view on the matter, saying that "in the context of the economy as a whole, it's a relatively small piece of what's going on ... don't see the same kind of credit crunch in the banking system as in the past." Indeed, liquidity remains robust throughout the global economy, providing ample capital for private equity firms to continue their acquisition frenzy.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Data contained here is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. All expressions of opinions are subject to change without notice

No comments:

Post a Comment