Monday, December 10, 2007

How TIPS Work ?

Let's examine the performance of a one such bond, specifically the 10-year = 3.5% TIPS sold at 99.818 on January 15, 2001, CUSIP 9128276R8. Each thousand dollar par bond cost $998.18 when issued. To calculate the first interest payment, we need the inflation adjustment on

the first payment date, July 15, 2001. The IRD calls the adjustment the "index ratio" since the factor is the ratio of the Consumer Price Index on the date of interest to the value of the Index on the date the bond was issued.

Using the on-line source referenced in endnote 3, the index ratio is 1.01848. The accrued principal balance on the first payment date is the par value of the bond times the inflation factor.

$1000 x 1.01848 or $1,018.48.

The first semi-annual interest payment is $1,018.48 x 3.5% / 2 or $17.82. The index ratio is 1.02022 when the second interest payment is paid on January 15, 2002. The accrued principal balance is $1,020.22 and the second interest payment is $17.85. Subsequent interest payments are calculated in the same manner. If inflation were 3.3% annually over the life of this 10-year bond5, the accrued principal balance at maturity would be

$1000 x (1 + 3.3%) ^ 10 or $1,383.58.

The bonds would be redeemed for $1,383.58 per bond and the final semiannual interest payment would be $24.21. Investors receive a Form 1099-INT reporting the interest paid during the year and a Form 1099-OID reporting the inflation accrual. For 2001, the 1099- INT would report $17.82 per bond.

The inflation accrual is the accrued principal at the end of the year less the accrued principal at the beginning of the year or on the purchase date, if later. The bond is valued at par in these calculations.

The index ratio at year-end 2001 is 1.021116. The ratio was 1.0000 when the bond was issued. The inflation accrual was $21.11 during 2001 $1000 * 1.02111 minus $1000 * 1.00000 = $21.11

and the 1099-OID would report this amount per bond.

The federal tax is calculated on the sum of the interest received plus the inflation accruals7. Interest on TIPS is free of state income taxes unless held in a retirement account.

TIPS Offer More Return. Yield to maturity (YTM) is the annualized pre -tax return of a bond purchased at the current market price and held to maturity. YTM will seldom be the same as the coupon yield because bond prices rise when interest rates decline and vice versa.

YTM on conventional bonds reflect many factors, including the market's estimate of future inflation. YTM on TIPS reflect similar factors except that inflation is not part of the equation. Thus the difference in yields is a rough measure of the market's forecast of future inflation.

Conventional Treasury bonds of intermediate maturities have been priced to yield 1 - 2% more than TIPS during the past five years. FYI, historical inflation has been 2.4% over the five years ending May 2003. The differential between long TIPS and long bonds has been 1.5 - 2.5%.

In essence, bond professionals have been betting that inflation will be less than 1 - 2% in the intermediate term and less than 1.5 - 2.5% over the long term.

If an investor agrees with these forecasts, TIPS are fairly priced compared to conventional Treasury securities. If an investor is concerned that future inflation might exceed these forecasts, TIPS are the better deal. To compare TIPS to bonds with different marginal tax rates, we need to compare after-tax returns. The after-tax return of a conventional bond is

approximately YTM times one minus the marginal tax rate.

YTM x (1 - Marginal Tax Rate)

The after-tax return on TIPS is approximately the sum of YTM plus the assumed inflation rate times one minus the marginal tax rate.

(YTM + Inflation Rate) x (1 - Marginal Tax Rate)

Friday, July 27, 2007

Futures Markets Bet Fed Will Cut Rates This Year

Fed-funds futures are monthly contracts, measuring expectations for the 30-day average of overnight U.S. interest rates. Fed-funds contracts enable investors to hedge or speculate on Fed action at each of its eight scheduled policy meetings each year. Earlier in the year, the markets were putting a much higher likelihood on a Fed rate cut than Fed officials were, but the strength of the economy and Fed Chairman Ben Bernanke’s warnings about inflationary pressures changed the market’s mind — until now.

Thursday, July 26, 2007

India's Strong Rupee

India's strong rupee is an enviable problem to have, according to the Economist Intelligence Unit:

In some ways, the present strength of the currency, which is now hovering just above the symbolic Rs40:US$1 mark, is an enviable problem. It suggests that the country's attractiveness to foreign investors is increasing and signals optimism about the Indian economy more generally.

...the rupee's appreciation has benefited the economy by making imports cheaper. This is no small benefit--containing inflation has been high on the policy agenda during the past year, as the annual inflation rate (as measured by the point-to-point change in wholesale prices) rose to 6.1% in January 2007, compared with 4.2% a year ago. The inflation rate has subsequently moderated. This may offer the RBI some comfort in its battle against inflation, but the bank's new, stricter inflation target (4.5-5% in 2007/08, down from 5-5.5% in 2006/07) suggests that there will be one more increase in interest rates by the end of 2007.

Why is the currency so strong?The main reason for the rupee's appreciation since late 2006 has been a flood of foreign-exchange inflows, especially US dollars. The surge of capital and other inflows into India has taken a variety of forms, ranging from foreign direct investment (FDI) to remittances sent home by Indian expatriates. In each case, the flow seems unlikely to slacken.

But it's not all good news:

However, the rupee's appreciation is alarming exporters, as it makes their products more expensive in overseas markets and erodes their international competitiveness.

The RBI's deputy governor, Rakesh Mohan, recently referred to the effects of the rupee's appreciation as a case of "Dutch disease". The term refers to episodes where large inflows of foreign exchange—usually as a result of the discovery of natural resources or massive foreign investment—leads to appreciation of the currency, undermining a country's traditional export industries. ("Dutch disease" originally referred to the adverse impact of the discovery of natural-gas deposits in the Netherlands on that country's manufacturing exports.)

There is already evidence in India of an export downturn in a number of sub-sectors. In the apparel sector—one of India's major export industries--the strong currency has eaten into the value of exports to the US, which declined by 3.5% year on year in January-April 2007. During the same period, apparel exports to the US by China, India's most important competitor, rose by 57%. Moreover, for India the decline marks the reversal of a positive trend—apparel exports to the US rose at an average rate of 21% a year after import quotas were phased out at the beginning of 2005.

...policymakers cannot afford to ignore the problems of exporters. Although exports account for a relatively small share of the economy, India's rapid export growth in recent years has been an important catalyst of economic growth. Given the limited extent to which the RBI can intervene in the foreign-exchange market in the face of large and sustained capital inflows, policymakers can only stem rupee appreciation substantially by easing limits on domestic firms' overseas investments or restricting inflows--for instance, through further controls on ECBs. The RBI has already taken tentative steps in this direction, making it more difficult for Indian firms to borrow in foreign currency and eliminating the exemption from ECB limits previously enjoyed by real-estate firms.

*Source: The Economist

China Interest Rates

The increase came a day after the government reported that annual growth accelerated to 11.9 percent in the second quarter, the fastest rate in 11- years, from 11.1 percent in the first quarter. The People's Bank of China, the central bank, ordered an increase of 0.27 percentage point in commercial banks' benchmark one-year deposit and lending rates. That will take the one-year benchmark deposit rate to 3.33 percent from 3.06 percent. The one-year lending rate will rise to 6.84 percent from 6.57 percent.

"We have had very strong Chinese data in the past few days; the surprise would have been if China did not move. Further hikes are still very much on the cards. In the absence of moves in the exchange rate, domestic monetary policy is the best way to curb growth."

The central bank has now raised interest rates five times since April 27, 2006. It has also raised banks' reserve requirements eight times since June 2006.

"This interest rate adjustment will help to guide reasonable growth of credit and investment, adjust and stabilize expectations about inflation and maintain basic stability of general price levels," the central bank said on its Web site, www.pbc.gov.cn/english/.

The central bank also raised the interest rate on sight deposits to 0.81 percent from 0.72 percent, the first time it has adjusted that rate since February 2002. Chinese interest rates rise or fall in increments that are divisible by nine because it makes calculations easier for banks, which charge interest based on a 360-day year.

One reason economists expected a rate rise is that consumer inflation accelerated to 4.4 percent in the year to June, the fastest pace in 33 months. That high rate of inflation puts deposit rates well into negative territory, giving savers an incentive to take money out of the bank to bet on the red-hot stock market.

Friday's increase is the first in two months. On May 18, the central bank raised the benchmark lending rate by 0.18 percentage point and the deposit rate by 0.27 percentage point -- at the same time increasing banks' required reserves and widening the yuan's daily trading band against the dollar.

Source: Bloomberg, pbc.gov.in & Reuters, Beijing

BRIC Economies

- French retailing giant Carrefour agreed to buy Brazilian retail chain Atacadao in a US$1.1bn deal.

- Brazilian energy group Petrobras is in talks with Japanese trading company Mitsui & Co about supplying Japan with up to 800 million gallons a year of ethanol within four years. In Brazil, the biofuel is generally produced from sugar cane.

- UK insurance group Aviva is to set up a direct-sales network in Russia, attracted by the country’s growing wealth. Aviva aims to become one of Russia’s top-five insurers by 2012.

- VTB, Russia’s second-largest bank, unveiled plans for a multi-billion dollar IPO, with listings in Moscow and London.

- German automobile manufacturer BMW opened its first assembly plant in India to cater exclusively for domestic customers. The move reflects continuing growth in demand in India for luxury goods.

- India’s ICICI Bank announced plans to raise US$5bn in a new share issue.

- Automobile sales increased by 35% in China last year, making it the fastest growing major car market in the world.

- China’s foreign exchange reserves, already the world’s largest, grew to US$1.2 trillion in the first quarter of this year.

The BRIC markets delivered a return of 4.0%* in April in US dollar terms. India delivered the strongest returns among the BRIC markets over the month, with local currency strength having a sizeable positive impact on performance in US dollar terms. Returns from the Brazilian market were also ahead of the BRIC index. The country’s central bank reduced interest rates by 25 basis points to 12.5%, continuing with its policy of monetary easing. Other economic news included the release of data showing Brazil recording a current account surplus of US$817m in March and retail sales growth of 9.4% year-onyear in February. The Chinese market delivered a good absolute return although performance was behind the BRIC index.

We remain positive on the outlook for the BRIC markets. Our base case scenario is for a soft landing for the global economy in 2007. This mid-cycle pause is expected to be followed by a reacceleration of global growth next year. The emerging economies are also experiencing a shift in the balance of growth towards domestic demand and are likely to continue to deliver growth well above that of developed markets. This strength of the emerging economies, which have become less reliant on US growth, is supporting markets, while valuations are, broadly speaking, not expensive and earnings growth is generally solid.

The outlook for Russia remains relatively favourable, in our view. Valuations are at reasonable levels and economic growth data continues to be above expectations. As Russia’s economic performance is now based largely on domestic consumer and investment demand, it is somewhat insulated from external shocks (in the absence of a significant fall in oil prices). WTO accession is expected this year and will bring additional economic benefits - it is anticipated that GDP will be boosted by US$19 billion. We are also positive on the prospects for Brazil. Growth statistics are firming, following a period of considerable volatility. The demand side of the economy is particularly strong and, with the expected continuation of monetary policy easing, is likely to remain so. Valuations are attractive and earnings upgrades have been coming through in the materials sector, while non-material sectors continue to display strong earnings growth. We are broadly neutral on the prospects for China. The economy is growing at a faster-than-expected rate (first quarter GDP growth was 11.1%) although further monetary tightening is expected as inflation is picking up. We are finding few stocks which have good upside potential, however, with market valuations at a premium to broader emerging markets. India is our least favoured BRIC market on a shorter-term view although its long-term investment potential remains compelling. Economic growth is strong, but overheating is evident in certain sectors especially real estate and consumer credit. Market valuations have improved and earnings are expected to grow by 20% this year, but there is a risk of downgrades if monetary policy continues to be tightened.

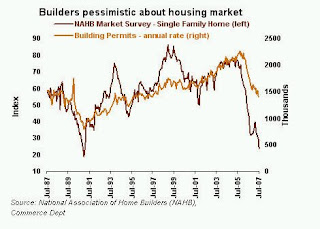

Housing Market

Last month, Office of Federal Housing Enterprise Oversight (OFHEO) released their quarterly estimates of housing prices in the US. It tries to track what happens to the price of the same house over time as it is bought and sold, it avoids some of the problems of prices measured by the median sales price. Furthermore, it is separately calculated for each Metropolitan Statistical Area (MSA), which provides a lot of texture to our analyses of the housing market.At any rate, figure 1 of what the most recent data shows for some of the US's largest coastal cities - the ones the enjoyed the biggest price appreciations during the period 2000-05.

In a rather remarkable display of synchronization, all of these cities are showing rapidly falling rates of price appreciation. Boston, San Diego, and San Francisco are now registering negative year-over-year real price changes, and it seems likely that in three months it’ll also be able to add New York, L.A., and Washington DC to that list. Note that the states that contain these particular MSAs account for about 40% of the population of the US.On the other hand, there is another 60% of the US that lives in interior states that did not go through the most recent big price appreciation. Unfortunately, it seems that house prices are leveling off - and in some cases, falling - in those places, too.And as for the longer view: the figure 2 shows the 2-year price change (to better smooth out some quarterly variability) in major coastal cities of the US over the past twenty years.

Based on past experience, it seems very reasonable to think that only in the very early stages of a many-year-long price correction. Don't think about the housing market turning around in 6 months, or even in a year or two; I'd suggest that you think about it gradually falling and leveling off over the course of the next 5-7 years or so.

Based on past experience, it seems very reasonable to think that only in the very early stages of a many-year-long price correction. Don't think about the housing market turning around in 6 months, or even in a year or two; I'd suggest that you think about it gradually falling and leveling off over the course of the next 5-7 years or so.

Wednesday, July 25, 2007

Housing and subprime woes

Housing and subprime woes Federal Reserve Bank of Philadelphia President Charles Plosser is keeping an optimistic view on the matter, saying that "in the context of the economy as a whole, it's a relatively small piece of what's going on ... don't see the same kind of credit crunch in the banking system as in the past." Indeed, liquidity remains robust throughout the global economy, providing ample capital for private equity firms to continue their acquisition frenzy.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Data contained here is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. All expressions of opinions are subject to change without notice

US Economics: Upbeat Message Expected from Bernanke

US Economics: Upbeat Message Expected from BernankeFed Chairman Bernanke is slated to deliver his semi-annual monetary policy report to Congress this week.

We expect a “steady as she goes” message, with the Fed chief citing an apparent pickup in the economy's growth pace following a very sluggish 1Q. At the same time, Bernanke is likely to note that while core inflation has drifted lower in recent months, there is some risk that this moderation may not be sustained.

There is considerable interest in what Bernanke will say about housing and the subprime mortgage market. We believe that he will continue to downplay the direct hit to the economy from the subprime debacle while also expressing some cautiousness that contagion remains a risk.

Why are Fed officials relatively sanguine about subprime? A little arithmetic will help to put things in context. Residential mortgage debt outstanding in the US currently totals about $10 trillion. Adjustable rate subprime represents roughly 8% of the market, or $800 billion. Many experts believe that about 20% of this debt will ultimately default. If we make a conservative assumption of a 50% loss on the underlying collateral, that means that the economic loss would total $80 billion (or 0.6% of GDP).

By comparison, the S&L crisis of the early 1990s triggered an economic loss of approximately $150 billion - or 2.5% of GDP (the US economy was a little less than half as large then as it is now). Moreover, the S&L-related losses were heavily concentrated in lending institutions located in certain regions of the US (e.g., California, Texas). In contrast, the losses associated with the current subprime problem appear to be dispersed throughout the global investor community. So, by itself, the scale of the subprime problem is relatively modest. It's the fear of contagion that represents the real threat to the economy.

What else will Bernanke say this week? We believe that the Fed's economic forecasts will need to be tweaked. In February, FOMC members were predicting 2 1/2-3% GDP growth this year. Because of the softness in 1Q, such a growth outcome now looks a tad aggressive. However, the unemployment rate is currently near the bottom end of the range of prior forecasts. Moreover, the core PCE is already a bit below the bottom end of the 2-2 1/4% range that had been projected for 2007.

Still, there is always a risk that high energy prices could spill over into core inflation, although it hasn't happened to this point. So the Fed Chairman will likely continue to talk tough on the inflation front. However, it's also becoming increasingly clear that the recent turmoil in the housing market is leading to a moderation in shelter costs. Indeed, the notorious owners' equivalent rent (OER) component of the CPI has slipped from a year-over-year pace of 4.2% back in February to +3.5% in May. A rising supply of rental units - in part reflecting the sizable inventory of unsold new homes and condominiums which are gradually transitioning to rental properties - means that the moderation in rents could continue. Indeed, we suspect that OER (a little more than 30% of the core CPI) could slip by as much as a full percentage point over the next year. This would definitely help contain core inflation.

Source: www.morganstanley.com

Equity markets (Globally) advanced to fresh highs, climbing the recognizable wall of worry. The U.S. subprime mortgage market implosion continues to be the central focus of much of the worrying, particularly because our housing market hasn't yet hit base. Investors are concerned that the problems could spread to the broader financial system and potentially quash consumers.

Hitherto Federal Reserve Board Chairman Ben Bernanke reported to Congress on July 18, 2007, that while the housing woes continue and could negatively impact consumers, inflation risks remain in the Fed's crosshairs.

Ratings agencies finally cut their outlook on billions of dollars in lower-credit quality debt. Bear Stearns fessed up that its two subprime-focused hedge funds are worth practically nothing, lending support to rumors that many hedge funds are not appropriately marking down the value of their most illiquid subprime mortgage securities. The ABX Index (a popular gauge of subprime mortgage-backed securities) has lost more than 55% of its value.

# The continued buoyancy of the markets.

# The broadening advance in the global economy.

# The pickup in U.S. economic growth.

# An orderly decline in the dollar.

# Tame inflation, which allows market interest rates to act as a shock absorber each time fears of a crisis or growth slowdown flare up.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Data contained here is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. All expressions of opinions are subject to change without notice.

For years now we have warned of tsunami like capital waves crossing the globe bringing financial drama with it. We have pointed to the structural problems that could give rise to the damage these waves will cause. We have warned of the Central Bank’s moves away from the U.S.$. We have also warned of the damage the Trade deficit is doing to the U.S. We have also warned of global foreign exchange and rates crises.

We coined the expression “Live now, Pay later” syndrome that has been all-pervasive in the U.S.A. Add this to the “so far, so good” attitude and what happened this week in global markets has been long overdue. It signals that globalization and the free flow of capital across this globe of managed foreign exchange rates, plus the interdependency of global economies will undermine all paper currencies to some extent. This week saw that begin . Probably a group of global funds thought the time was ripe in many markets to rattle some cages and down the markets went. That they should have this ability and power is the frightening thing and the situation can only worsen as other speculators and fund powerhouses get the scent of this action.

Many have touted a collapse in the $, but we say that this is not a necessity for a rise in the gold and silver prices to take place. A drop in the level of confidence in the U.S. unit is all that is necessary. Well we are seeing that in the globe’s foremost of financial institutions, the Central Banks as of now. Whither they go, go us.

Central banks are, across a broad front, increasingly diversifying their reserves, including cutting holdings of the U.S. $. Italy, Russia, Sweden and Switzerland have made “major adjustments” in foreign-exchange holdings favoring the € and the Pound Sterling between September and December 2006. Central banks are open to saying they’ve been diversifying to improve returns and reduce exposure to any single currency, which means, selling the $.

And the U.S. is not helping itself either because last month saw the Capital account fail to support the Trade deficit in January. If this continues, that alone could drop the $ like a stone. After all, the U.S. has become utterly dependent on the Capital account to fund the Trade deficit as it reaches new record levels every year.

The $ accounted for 65.6% of the world’s currency reserves in the third quarter of 2006, down from a peak of 76%, according to the International Monetary Fund.

Two Central Bank surveys were done recently looking at the extent of $ diversification,here are the conclusions of one [very similar to the other]:

Central Banking Survey:

*The respondents in this confidential survey don’t include the People’s Bank of China or the Bank of Japan , which together hold the world’s largest foreign exchange reserves [they account for 30% of total reserves held worldwide, or $1.5 trillion].

*Of the 47 central banks that responded by December to the survey, 21 of them, managing reserves of $630 billion, said they had increased the share of their reserves held in the €, and 15 of those said they had done so at the expense of the $.

*The survey showed that seven central banks said they had cut the share of reserves held in the €.

*Nineteen central banks said they had cut the share of reserves held in the U.S.$, while only 10 had increased the share of reserves held in the $. Only five of the latter group, with reserves totaling $70 billion, said they had done so at the expense of the €.

*Nine central banks raised the pound’s allocation, while four cut its share of reserves.*

Four central banks reported cutting their allocations of the Swiss franc, and none reported increasing its share.

*Six central banks said they had raised their yen allocations, while four cut their allocations to the Japanese currency.

*The shift into the € on the scale suggested by the survey would still leave the $ as the dominant reserve currency by a large margin. The International Monetary Fund has said that in the third quarter of 2006 the $ accounted for 66% of foreign currency reserves, while the €, accounted for 25%. In the second quarter, the $ accounted for 65% of reserves, and the € 25.5%. [This is a small change in terms of the risks to the $.]

*Central banks are still investing in riskier assets as they chase greater returns on yields. 69% said they were looking for more yield, having been forced to widen their asset range by a low-yielding environment. More than half of the respondents said there is scope for central banks to diversify beyond traditional assets into equities, and around a third said banks should invest in commodities.

*After a long decline as a reserve asset, the survey indicated that gold may be about to make a comeback. Some 63% of central banks said gold had become more attractive following recent price rises and an increase in market liquidity. But gold’s role as a safe haven in the wake of natural or man-made disasters is also part of its attraction for central bankers .

Please note that not one of these banks have stated they no longer want to hold the U.S.$, because of the risks to its value. We do not believe this is their major consideration. Why, because all currencies are interdependent and one currency cannot divorce itself from another, so long as the pattern of international trade is as it is. They are fused together. Ideally they only have to target inflation to maintain price stability. Exchange rates are not an issue in the main global blocs, such as the U.S. in the eyes of the Central Banks. Ideally they would want fixed exchange rates to stabilize global trade.

Alas, the Central Banks have no option but to switch to other currencies to improve their reserves, because of the sheer volume of their holdings of the $. Gold or silver or other commodities just could not accommodate their demand, unless the metal prices had an additional nought at least, on the end of them. [Huge stockpiles of oil could be a way to go, but storage facilities have to be built to accommodate this.]

But with such diversification added to the efforts of China in moving away from the $, the present levels of exchange rate values will just not hold in a $ crisis and it is naïve to think they will. But then again where else can they go? It is only fair to say that Central Bankers ignore exchange rate moves in their decision-making regarding currency holdings. Yes, they differentiate between ’soft’ and ‘hard’ currencies, but yield has to be the main criteria. So the vulnerability of the $ grows by the day.

The bottom line is this, there is no true haven from the $ in other currencies. In a crisis they will try to cling to each other, with some being forced to lower or raise their exchange rates with important trading partners. But essentially they are all in the same boat together.

But where a national economy’s health is dictated by exports, Central Bank will intervene to ensure trade competitiveness is ensured [e.g. Japan or India]. As we watch many Central Banks intervene in their exchange rates in this way in the future, we will see many currencies falling with the $ encouraging capital flows to grow even larger as they used to in the days of fixed rates in the foreign exchanges. As we point out weekly, currencies relate to one of the main three trading blocs of the world and attempt to keep their exchange rate in line with that one. For instance South Africa’s main trading partner is Europe, Australia’s is China, hence the exchange rates moves we are seeing now.So the world’s most important exchange rate is the $:€.

So Central Banks want stable exchange rates and do intervene. This is like a red rag to a bull to speculators. With Central Banks holding together the foreign exchanges of the world, Capital flows will find little to prevent them from going where they want to. Another feature of global markets that we have been highlighting is the concept of, “He who sows the wind reaps the whirlwind.” As Central Banks try to hold the system of exchange rates together with as little rupture as possible [as we have seen in the last few years], so they will fall foul of the Capital flows flooding across borders to greener pastures, pressing Central Banks as in the past, but with greater power than ever before.

We have heard it said that switching out of major currency holdings is easy, for Central Banks, they just enter the foreign exchange markets and sell what they receive. To say that is naïve, because like any market, if supply is heavier than demand, prices will fall. With so many diversifying from the $, the growing overhang is finding nowhere to go, except home. The continuous outflow of the $ is gradually oversupplying an unwilling market. It takes little to understand the interest rates alongside the $ exchange rate has to go down, not in a controllable way, but in the face of a future tide of U.S. $’s coming home. We have in the past mentioned Capital Controls are a possibility at some stage in the States, to hold back this flood from damaging the internal economy through inflation, against a backdrop of deflation in many areas of the economy [but not all]. But a consequential collateral damage will be to the nations holding onto their exchange rates with the $. They will have to revalue , or let their exchange rates rise, if their economies are dependent on the U.S. This will weaken them internationally. Those dependent on the Eurozone or on Asia for their international trade will however, rise out the $ storm.

But, ‘hot money’ now called the ‘carry trade’ will look, along with the hedge funds and the newly born George Soros’, will be there to push exchange rates the way they should go and maximize their impact and profit from any resistance in their way. The result will be to drive all types of solid Investors to safe havens, including gold silver and whatever else holds value in these days.

The development of the Internet, the knowledge revolution, as well as other aspects of the information and communication revolutions will add “moments of force” [weight added to momentum] to the capital flows that will shake weakened economies, prompting protective action like exchange controls or Capital controls from wreaking havoc with these Central Banks. The memory of George Soros, breaking the Bank of England and making one billion pounds profit overnight, is well remembered amongst Central Banks.

At Gold & Silver Forecaster we expect the world’s currency system to move closer to a series of major crises, quicker than before and accelerating as it goes. We will continue to focus on the external developments that influence gold and silver prices as well as the simple gold and silver market factors. We see investment demand growing as a price influence as we progress down this road. We are led to believe that we are the only such letter with this perspective and who cover the monetary aspect in this way. Therefore we have to emphasize that it is this influence on gold that will drive the gold and silver prices to new heights, as investment demand grows. Keep in touch with us closely, so we can help you really benefit from these markets . We are a “must have” newsletter alongside others.

Last week’s global markets pullback was merely a taste of what is to come. The flow of money was not just market driven, it was driven by funds large enough to rock global markets. And let’s be clear about one fact in these markets, it does not take a collapse of the $ or any other currency to make gold and silver an attractive investment, just the fear of one . This fear and uncertainty will grow in the months and years to come making the flow of investment funds into gold a steady feature until its price will inspire confidence and consequently the currency of the holders.

Source: Please subscribe to www.GoldForecaster.com for the entire report.

Monday, April 23, 2007

China

Since China was in the news this week, I thought it might be fun to take a look back at what people were writing about China many years ago. Clearly a lot has changed over the past fifteen years... but much remains the same. Here's a nice little piece from The Economist, dated July 4, 1992, that sounds at the same time a bit strange and rather familiar:

China: Return to goThese are heady days for China's economy: reformers are winning, business is booming and foreigners are scrambling to invest. The cautious, however, will recall that when China was last like this, only four years ago, the economy went out of control and inflation reached an annualized rate of 80%. The government responded with a tight squeeze on credit and imports. Economic growth fell from 11.5% in 1988 to 4% in 1989 (a decline sharpened by Western sanctions after the Tiananmen Square killings). Will it happen again?Most people are too thrilled with recent events to waste time on such morbid speculation. In the first five months of 1992, China's real GDP was 11% bigger than in the same period last year; industrial output was 18% higher; real income per person in the cities 16% higher. In the southern Guangdong province industrial output was up by 26% and exports by 32%.Meanwhile, the reformist directives multiply at bewildering speed. In mid-June it was suggested that five cities along the Yangzi River would be given the latitude to attract foreign investment; this week the government announced that the Yangzi's open cities would actually number 28.Still more significant was the formal announcement on June 25th that service businesses such as retailing, transport and banking will be opened to foreign investors. This part of China's economy offers wider scope than any other for improved efficiency, growth and profits -- and the government seems unperturbed by the social implications of allowing foreigners to shape a consumer culture in China.The foreigners are eager to begin. In the first five months of 1992 the government approved 8,900 foreign-investment projects, with a value of $ 10.5 billion, around three times the comparable figures last year. Overseas Chinese from Hong Kong, Taiwan and South-East Asia are showing especially keen interest. They know China better than other foreigners, and as they get involved will have a farther-reaching influence.Li Ka-shing, Hong Kong's biggest businessman, has for the first time taken a share of big property deals in northern China (in Shanghai and Beijing). He is also committed to taking stakes in bridge and highway projects in Guangdong. Robert Kuok, a Malaysian tycoon who is a partner of Mr. Li's in the Beijing and Shanghai projects, recently made three Chinese Property deals in four days. Over the weekend of June 27th-28th, Shanghai signed a total of 20 property-development agreements with foreigners.The worry, however, is that such developments will help the economy overheat -- as it did in 1980, 1985 and 1988 -- and the government will then cool it by the same painful methods as before.Danger signs are already plentiful. Consumer prices in the first five months of 1992 were 11% higher in the cities than in the same period last year. The government's budget deficit last year, by IMF rather than Chinese arithmetic (which includes foreign loans as revenue), was 78 billion Yuan ($ 14.6 billion) -- around 20% of government spending and 3% of GNP. This year spending continues to grow faster than revenue.The culprits, as usual, are the loss-making state enterprises. Despite government exhortations to improve their performance, the biggest state companies lost 8.2 billion Yuan in the fist five months of the year, 20% more than in the same period last year. Although the central bank has increased banks' reserve requirements, rumor -- supported by a weakening of the Yuan on the free market -- has it that money supply grew at its fastest-ever rate during the first five months of this year.Optimists are undismayed. They say things have changed since 1988: more of the economy is in private hands and there are fewer of the rigidities that stopped supply from responding to price movements in 1988. True enough. But even if an economy is efficient, which China's is not, it will inflate predictably in response to the kind of pressure China is under. Go-go could all too easily become stop-go.

Turns out that the astonishing estimates of China’s economic growth, which I showed you below

China's Economy Probably Grew 10.4 Percent as Exports Boomed on Bloomberg, Apr 17 -- China's economy, the world's fourth largest, probably grew more than 10 percent for the fifth straight quarter on booming exports and an investment rebound.Gross domestic product expanded 10.4 percent from a year earlier, according to the median estimate of 24 economists surveyed by Bloomberg News, the same pace as in the fourth quarter. The statistics bureau released first-quarter figures in Beijing on April 19.China's foreign-exchange reserves grow by $1 million a minute, flooding the economy with cash and fueling investment and inflation. ...China's economy has more than doubled in size since the end of 2000 and last year's 10.7 percent expansion was the biggest since 1995. Growth for each of the past four years was at least 10 percent....Urban investment in factories and real estate probably climbed 23 percent in the first three months from a year earlier, the survey showed. That compares with 13.8 percent in December and 24.5 percent for all of last year.

China's Economy Surges at Faster-Than-Forecast 11.1% on Bloomberg, Apr 19 -- China's economy grew at a faster- than-forecast 11.1 percent pace in the first quarter from a year earlier; raising the likelihood the government will increase interest rates to curb the risk of overheating.Growth accelerated from 10.4 percent in the previous quarter, the statistics bureau said in Beijing today. China's benchmark stock index fell 4.7 percent before the release, triggering declines in Asian and European shares, on speculation borrowing costs will rise.Premier Wen Jiabao said the government will take steps to curb lending and investment in factories and property and rein in the record trade surplus. Inflation accelerated to 3.3 percent, the fastest pace in more than two years, and breached the central bank's 3 percent target for the year."Growth has been driven by continuing strength in investment and continuing strength in politically sensitive exports," said Glenn Maguire, chief Asia economist at Societe Generale in Hong Kong. "China needs to cool profits and the easiest way to do that would be to allow the Yuan to appreciate at a faster rate."

Red hot? Yellow hot? White hot? I'm not sure exactly what the appropriate temperature description for China's economy is, but it's clear that it is growing really, really fast, and even for China. The potential implications for China's monetary policy are clear. And the fear that China's central bank might have to take steps to cool down the economy provoked a continent-wide selloff in stocks today, as Reuter’s reports:

SINGAPORE (Reuters) -- Asian shares fell sharply on Thursday as investors worried that Chinese economic data could show an overheating economy and prompt Beijing to announce more interest-rate hikes or other growth-cooling measures....China stocks fell 3.3 percent in Shanghai as investors worried that strong data could lead to more government measures to reign in the booming economy.

Yes, there can be too much of a good thing...

China's central bank takes more steps to try to cool down the Chinese economy (China's Monetary Policy):

China Raises Banks' Reserves Sixth Time in 10 Months on Bloomberg, Apr 05 -- China ordered banks to set aside more money as reserves for the sixth time in less than a year to slow inflation and investment in the fastest-growing major economy.The reserve ratio will increase by 0.5 percentage points to 10.5 percent starting April 16, the People's Bank of China said today in a statement on its Web site.Central bank Governor Zhou Xiao chuan is concerned that cash from a record $177.5 billion trade surplus is stoking excess investment in an economy that expanded 10.7 percent last year, the fastest in more than a decade. The central last month raised interest rates for the third time since April 2006 to help reduce the risk of accelerating inflation and asset bubbles."Chinese authorities have a significant liquidity problem on their hands," said Tim Condon, an economist at ING Bank NV in Singapore. "The government's probably acting in response to the very buoyant loans growth we saw in January and February. They're going to keep watching this."

While the PBoC has also raised interest rates recently (a little), it seems that they are still primarily trying to use quantity tools (controlling how much lending banks can do) rather than price tools (at what interest rates can banks lend) to manage the economy.The Chinese central bank's historical use of quantity tools instead of price tools is quite consistent with China's history as a centrally-planned economy. After all, the whole idea behind central planning is to have a planner dictate quantities produced, rather than allowing price signals to tell firms how much of what to produce. Managing the money supply through quantity controls is simply an application of the same principles.But there are good arguments that suggest that the PBoC should shift toward using interest rate management more and quantity tools less - see for example "China: Strengthening Monetary Policy Implementation," by Bernard Laurens and Rodolfo Maino of the IMF. While such a shift would probably a very good idea for an economy that is no longer centrally-planned, that change does not seem to be happening yet. It's also worth wondering how much Chinese interest rates would have to go up in order to effectively cool down the Chinese economy. The answer might be quite a bit. Furthermore, raising interest rates brings with it some complications that the PBoC may be trying to avoid. Specifically, if China does indeed raise interest rates significantly, this could put a lot of additional pressure on the Chinese authorities to allow the Yuan to appreciate. If they raised interest rates without allowing the exchange rate to change significantly, the PBoC could end up accumulating dollars even faster than they already are.So it seems unlikely to me that we'll see any significant increase in interest rates in China until the PBoC is willing to allow faster Yuan appreciation. Which brings us to one last point: as Menzie Chinn reminded us recently, the Chinese authorities could also cool down the economy very effectively by allowing the Yuan to appreciate against the dollar. They haven't used the exchange rate tool much in their efforts to slow down overly-rapid economic growth... but if they start finding that their quantity-management tools aren't as effective as they used to be, they might. And in combination with higher interest rates, a change in the exchange rate could very effectively sprinkle some cooling water on the red-hot Chinese economy.

Sources:

http://www.bloomberg.com

http://www.imf.org/external/pubs/ft/wp/2007/wp0714.pdf

Friday, February 9, 2007

Argentina: Looking to Settle Bilateral Debt

In the wake of securing a deal to repay US$960mn in debt that Spain extended during the 2001 crisis, Argentina appears ready to discuss its other bilateral obligations. The country hopes to settle US$6.3bn in outstanding debt with the Paris Club by 2015 according to reports in Argentina’s Ambito Financiero. Economy minister Felisa Miceli is said to be preparing a proposal to the Club for the beginning of December, in which Argentina would be allowed to repay Spain ahead of the rest (by 2012) in light of the ‘bail-out’ nature of that loan.

Brazil: Where do we go from here?

Over the last three years, Brazil has taken great strides toward reducing its traditional vulnerabilities. Its lumbering public and external debt burdens are being tamed, perceptions of financial stability have helped secure more stable sources of capital flows, and it has succeeded in opening and broadening its trade profile. All these developments will make the country much more resilient in the face of the coming downturn. The next step toward investment grade, however, will require the Lula administration to address some of the economy’s fundamental structural challenges, and may well expose an internal struggle for the soul of this PT government. But the choice is between the government’s social democratic agenda and its target growth rate of 5% in 2007.

Brazil’s investment ratio currently stands at 17.5%, down significantly from 32% in 1975. For gross capital formation to rise, however, it is not enough for the real interest rate to fall. Improvements are needed with respect to the overall business environment. Excessive growth of public spending places upward pressure on taxation. Primary spending has increased at an average of 9.4% in real terms through the first Lula administration. Given the government’s commitment to maintain a 4.25% primary surplus and reduce public debt, this is only possible with higher taxes. Another factor inhibiting investment is the dire state of the country’s transportation infrastructure, which some say costs businesses $5 billion per year in efficiency losses. But due to fiscal constraints, addressing this requires private capital. To achieve this, as I’ve said, the government will have to strengthen the country’s regulatory framework, and begin to look more seriously at the public-private partnership scheme.

Ecuador: Dollarization safe…for now.

Since his election victory on September 26, President-elect Raphael Correa has ruled out any sudden changes to the dollarization of Ecuador’s economy, but added that he "would be opposed to keeping the policy going indefinitely, because one of the symbols of a country’s sovereignty is its currency." EDC Economics does not believe that there is sufficient displeasure in Ecuador at this point with the dollarization regime to motivate such a move in the near- to medium-term. Mr. Correa has, however, indicated on several occasions that he would be in favor of ‘renegotiating’the country's external debt. We have enough reason to believe that he would carry

out such a threat, and caution that he should be taken at his word in that respect. That said, a collapse of the dollarization regime would not necessarily go to follow. Mr. Correa does have a reputation of being extremely erratic and, despite being a US-trained economist, a move toward more Chavez-inspired economic heterodoxy should not be ruled out.

Mexico – Impacts of US slowdown and Domestic Politics should be watched closely

A US slowdown is already underway. Mexican companies whose main sources of income are dependent on the US housing market and the US consumer will feel the greatest impact. And now US manufacturing is also facing its problems with November’s ISM release coming in below the threshold 50 mark, meaning the sector is in contraction. Meanwhile, President Calderon was sworn in last week. The peso showed little reaction and the stock market hit another record, but political developments deserve close attention. Monetary policy and good debt management are important but can’t do it all. Longer term structural issues such as declining oil reserves will weigh on the fiscal accounts. Production from Cantarell is projected to fall 14% annually between 07-15.

In 2004, its output accounted for 63% of Mexico’s total crude production.

Peru: The Herd Mentality in Full Effect

In July, EDC Economics upgraded Peru to ‘BB+’, citing "healthy growth and stable inflation combined with sound macroeconomic management." Then in August, Fitch Ratings upgraded the country to ‘BB+’ due to Peru’s "rapidly growing exports…as well as strong output growth." Now, on November 20th, S&P also bumped the sovereign’s MLT FC credit rating to ‘BB+’, based on strong growth in the context of "a strengthening macroeconomic framework characterized by low inflation…current account surpluses, and a fiscal consolidation strategy."

Russia - Strong Fundamentals and Reserves Mitigate Risk Profile

The country is registering very respectable growth of 6.4% this year thanks to strong macroeconomic and financial indicators offset by weak institutional factors. Notwithstanding massive export revenues, economic growth is being hindered by infrastructure bottlenecks, particularly in the oil and gas sector. This is expected to continue in the foreseeable future, as fixed capital formation remains among the lowest of all transition economies at under 20% of GDP. The resulting bottlenecks are also hindering the country's ability to attain the 7.5% annual

growth required to meet the government's target of doubling GDP in ten years. Still, economic growth remains high at around 6% thanks to rising wages and credit growth within a context of rising government expenditures. Moreover, foreign exchange reserves are still growing, and recently exceeded US$280 billion - the world's third largest; and the stabilization fund also surpassed $80 billion. These joint reserves should allow Russia to weather any economic downturn for some time.

Turkey - Outlook Clouded by Troubled EU Negotiations and Slowing Economy

Despite continuing decent economic results, Turkey's economic outlook may have been caught up in the possible suspension of negotiations over EU entry. At the time of writing, the EU Commission has recommended that accession talks with Turkey be suspended in eight of the thirty-five policy areas (chapters) over Turkey's delays in opening its ports and airpots to Greek Cypriots. Turkey has given no indication that it would bow to EU pressure to abide by that condition. Moreover, growth, which has averaged over 6% yearly in the last three years, may slacken this year on the back of the slowing world economy. A complicating factor for Turkey is

the looming 2007 presidential race which will be exacerbated by the chasm between Turkey's secular forces and the ruling AKP party. The economy is also slowing, with most recent industrial production (IP) data slowing to 5.8% in September, versus 9.3% the previous month. Most recent figures show inflation tracking at slightly less than 10% (y/y), far above the Central Bank original target of 5%. Moreover, the October trade deficit registered at $4.4 billion, for a cumulative January-October total of $44.5 billion (8% of GDP). The problem with Turkey is that the the EU negotiation/integration process had been one of the key mitigants of country risk by serving as

backstops to economic policy. If EU integration stalls, the country could find itself with only the current IMF economic program to provide a guarantee of economic sustainability. To sum up: Turkey's economic outlook has become clouded - stay tuned.

India - Solid Q3 Growth Numbers Underpins Continuing Creditworthiness

The Indian economy continued its strong expansion with GDP growing by 9.2% y/y (all figures y/y) in Q3, versus 8.9% in Q2 and 9.3% in Q1. These three results suggest that overall growth for teh entire year may exceed 8%. Key drivers of the economic expansion included trade, transport, and communications (+14%), manufacturing (+12% y/y), finance and insurance (+9.5%), and construction (+9.8%). The key agriculture sector, which still employs about half the population, registered growth of only 1.7%. Given much of the manufacturing output is for domestic consumption, the strength of the manufacturing sector is quite telling can be used as a proxy for domestic demand. As a result, while India's domestic demand appears to be quite robust, overall growth should dip next year as a result of tightening by the Indian Central Bank to tackle inflation, and slowing global growth. Expect growth to be in the 7-8% range - still respectable by any standards.

China - Growth Eases - somewhat - But Lots of Oomph Left in System

While GDP data indicated a continuing firm expansion in the third quarter 2006 (Q3/06) of 10.7% y/y, only slightly less than the 11.3% y/y growth registered Q2/06, industrial production (IP) in October slowed unexpectedly to 14.7% y/y, lower than the 16.1% y/y registered in September. At this point there are two possible explanations for the slowdown. First, the mix of monetary and regulatory measures implemented by Chinese authorities to slow growth - particularly fixed investment - may be starting to bite. Second, as many of the goods produced in China are for overseas consumption, the slowing October IP figure may reflect the slower pace of orders placed by firms as a result of the world slowdown. But export growth has remained solid (with

October's merchandise trade balance setting a record high of US$23.8 billion, up from US$15.3 billion in September), and therefore it may be too early to tell if the slowdown is affecting exports. One last note: foreign exchange reserves may have exceeded $1 trillion. To sum up, China's growth remains strong.

Taiwan - Quarterly Growth Data Higher than Expected, But No Miracles Looking Ahead

Taiwan's rate of economic growth accelerated in the third quarter to 5.0% y/y following a 4.6% y/y rate of growth in Q2. Nevertheless, growth is expected to scale back in view of slowing world economic growth and slowing consumption by Taiwanese households. The issue of slowing world growth - particularly in the US - is particularly appropriate to Taiwan, given the reliance on high-value-added electronic goods which is among the country's export staples. This suggests that growth is expected to decline slightly next year, although remain at a still-respectable level of about 4%.

Congo Republic (Brazzaville) – spending & good governance challenge progress

Macroeconomic performance has been improving, admittedly on the strength of buoyant oil

conditions. GDP growth doubled in 2005 to 7.9% and is expected to slow from an estimated 7.2% in 2006 to less than 2% in 2007, as oil production falls, before recovering to 6.5% in 2008, as a new field come on stream. Macroeconomic policy has been under the guidance of an IMF arrangement - Poverty Reduction and Growth Facility (PRGF), but the country experienced performance problems due to delays in transferring oil revenues to the Congolese treasury. Nevertheless, containing spending on the eve of parliamentary elections is among the key

challenges for 2007. The “Second Review” under the Fund program took place in June 2006 and then the PRGF had to be extended. The PRGF has been the pillar of the international rescue package needed to regularize the Republic of Congo’s very difficult financial position. The country has been eligible to the first phase of the Enhanced HIPC Initiative in 2006. Meanwhile, the country liquidity position has been improving markedly and foreign exchange reserves have been equivalent to 7.5 months of import cover earlier in 2006.

Iran – plenty of foreign reserves and low external debt

The consolidation of power in the hands of hardliners, which have been exacerbated by populist rhetoric, has pushed to the country in isolation, particularly over the nuclear issue. Existing sanctions by the US have been extended, and investors’ sentiment has been increasingly “mixed” and fluctuating in between opportunity and risk. This should have adverse implications on the needs to upgrade the oil and gas sector over the longer run. However, over the shorter run, Iran enjoys plenty of liquidity with foreign exchange reserves that could be in the area of US$65bn by the end of the fiscal year 2006/07 (end in March) equivalent to one year of import of goods & services. Iran has never been “as liquidity as” in nowadays. External debt problems are also a story of the past, as the external debt is equivalent to 10% of GDP.

Nigeria – on the path of balance of payments viable and debt sustainable

Nigeria has recorded a solid performance for the past 24 months and the outlook is equally encouraging with GDP growth of 7% by 2007 due to buoyant oil conditions. It has implemented rigorously an economic reform program, which has been supported by the IMF. It met the conditionality of the First Review of the Fund program Policy Support Instrument (PSI). Fund Board discussions for the Second review is scheduled for the second half of December 2006. Oil windfalls have led to budgetary and external current account surpluses. Business conditions are challenged by high domestic interest rates (of 14%), an on-going banking reform and changes in the exchange rate policy. Nevertheless, the country is in the process of reaching balance of

payments viability and debt sustainability after the conclusion of the international financial package that was reached in October 2005. The liquidity position is more than comfortable with foreign exchange reserves equivalent to 15 months of import cover. The external debt has been falling from US$35.9bn two years ago to less than US$5bn in 2006.

Thursday, February 8, 2007

News: NEW YORK (CNNMoney.com) -- The nation's trade deficit tumbled in October on lower prices for oil imports, but the gap with China kept growing ahead of a key trip to that country by Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and other top officials.Overall, imports topped exports by $58.9 billion in October, down from $64.3 billion in September, the Commerce Department reported. Economists surveyed by Briefing.com had forecast a much smaller decline, to $63 billion.But the deficit widened with China, which runs by far the biggest trade surplus with the United States of any other country.The report comes as Paulson, U.S. Trade Representative Susan Schwab and other officials left for China for meetings that are sure to bring up some contentious trade issues. Bernanke is due to join them after Tuesday's meeting of the Fed policymakers.

Comments: China is on everyone's mind these days, and as a result, almost all international economic news is now viewed through the China lens. As this news excerpt mentions, the trade deficit with China does indeed continue to widen even as the overall US trade deficit seems to have peaked (at least temporarily).But it's worth noting that simply looking at the US trade deficit with China is a bit misleading. In fact, US exports to China have been growing much faster than US imports from China. The problem is, of course, that the levels of exports and imports are very different, so US exports would have to grow much faster than imports in order for the US trade imbalance with China to stop rising.The following tables show how US exports and imports have changed in 2006 compared to 2005. First, let's take a look at changes by trading partner. US exports to nearly all of the US's trading partners have grown solidly over the past year, but exports to most of the developing world - including China - have done particularly well. Interestingly, the parts of the world that seem to be lagging in terms of US export growth are the rest of east Asia, such as Japan, Taiwan, and Korea.

Obviously, a huge chunk of the increase in US imports is oil. The interesting thing to notice in this table is that US imports of consumer goods have actually grown relatively slowly over the past year. Meanwhile, exports have grown solidly in the US's traditional strengths: capital goods (things like machinery, telecommunications equipment, and aircraft) and industrial supplies (things like chemicals, wood and paper products, metals, etc.).Meanwhile, Treasury Secretary Paulson heads to China to try to work some magic on the US trade deficit. The pressure on him to do so is substantial. But short of somehow managing to get Chinese consumers to do more spending and US consumers to do less of it, I think he has little chance of actually accomplishing that goal.

Source & Links: BEA (Bureau of Economic Analysis), CNN Money.com & Bloomberg

http://www.bea.gov/bea/newsrel/tradnewsrelease.htm

http://www.usatoday.com/money/economy/2006-12-11-treasury-side_x.htm

http://money.cnn.com/2006/12/12/news/economy/trade/index.htm?postversion=2006121211